Understanding and reducing revenue leakage in aged care

November 15, 2024 | Aged Care Finance

By Christopher Lyons, Senior Consultant

Revenue leakage is a silent but substantial challenge affecting many industries, and Australian aged care is no exception. Revenue leakage is the loss of revenue due to inefficiencies, errors, or missed opportunities, and it can undermine financial sustainability and jeopardise an aged care provider’s ability to deliver optimal care.

The AN-ACC funding model introduced a complete paradigm shift in the way RAC providers attract subsidies for care delivered. Much of the sector that we speak to has not completely transitioned in their mindsets or their processes, especially when it comes to managing their data and maximising their subsidy in a newly constrained model. The sector on average is $100 per bed per day better off under the new funding model but that definitely doesn’t mean that all funding is being optimised in all cases.

The new funding model is designed to be far lower margin than the former model so providers cannot afford to have any subsidy that can be lost or leaked. 45% of services are currently claiming below the level of their quarterly care minute target. Assuming the services are staffing to their target, these unfunded minutes are costing those providers $4.5m each month.

Revenue leakage in aged care is a hidden threat to financial sustainability

We all know that the Australian aged care sector operates within tight financial constraints. While government funding and resident fees provide the primary revenue streams, operational costs continue to rise due to inflation, workforce requirements, and compliance needs. Revenue leakage represents a substantial missed opportunity to reinvest in care quality, workforce improvements, and infrastructure.

In aged care, revenue leakage occurs when providers fail to capture, bill, or collect on all the funding they are entitled to. With the complexities of the AN-ACC funding model, which requires detailed compliance with care minute requirements and external resident assessments, even minor errors in billing or data tracking or delays in reassessment activity, can lead to substantial losses.

For instance, even a 2-5% revenue leakage due to small billing errors or uncollected fees can add up to significant losses annually. For a medium-sized aged care provider, this could mean the difference between breaking even and operating at a loss.

AN-ACC revenue leakage

Consider a 100-bed provider who is managing AN-ACC well. The provider has a care minute target of 215 minutes per resident, 44 minutes of which must come from a registered/enrolled nurse (90% RN, 10% EN). Also consider that despite admission/departure events shifting the actual care needs of residents, the provider’s AN-ACC funding has not adjusted accordingly. The provider’s care minute target is fixed for the quarter, but funding has fallen below the estimated maximum of $300 to $298.50 per resident per day. For each day this funding remains unaligned, the provider misses out on an estimated $150 in potential funding.

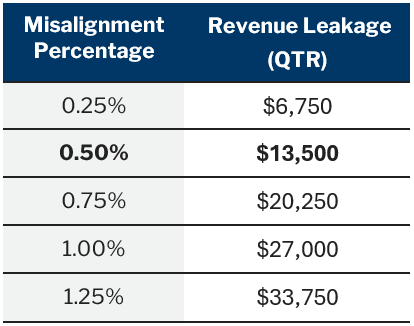

The seemingly insignificant 0.5% misalignment of funding can have substantial quarterly impacts:

- Over a Fortnight: $150/day × 14 days = $2,100 in missed funding

- Over a Month: $150/day × 30 days = $4,500 in missed funding

- Over a Quarter: $150/day × 90 days = $13,500 in missed funding

This accumulation of unrealised funding impacts the provider’s ability to allocate resources, staff, and enhancements to resident care. Without proactive reclassification and funding alignment, these missed opportunities quickly erode the financial efficiency of the facility.

In aged care, significant opportunity lies in proactively managing care minute allocations to optimise funding. We are noticing that providers who do not have a process or system in place miss significant funding opportunities by not aligning their care precisely with the AN-ACC funding model.

Impact of effective Forecasting & Scenario Planning

Effective forecasting of AN-ACC classifications has a profound impact on the long-term financial health of a facility, as it enables providers to achieve stable, predictable revenue streams that fully align with their care minute targets. In a 100-bed facility where admissions and resident classification changes occur regularly, accurate forecasting not only keeps funding aligned with care delivery but also brings broader financial benefits by:

- Maximising funding consistency: Forecasting classifications accurately ensures that the facility consistently receives full funding for its rostered care. This alignment minimises fluctuations in revenue, creating a reliable financial base that supports sustained operations and planning.

- Improving revenue predictability: Accurate forecasting allows providers to project revenue with greater precision, reducing financial uncertainty. With a clearer picture of future funding, providers can plan budgets more confidently and invest strategically, fostering long-term financial stability.

- Strengthening financial resilience: Minimising the gap between care delivery and funding helps the facility avoid bearing costs that go unrecouped. This proactive approach reduces financial strain, protects cash flow, and preserves the facility’s financial stability.

Incorporating effective forecasting as a standard practice enables providers to move beyond reactive financial management, securing a stable funding foundation that supports consistent, high-quality resident care and maintained growth.

Revenue leakage may seem like an invisible issue, but its impact on the aged care sector is very real. Given the financial challenges faced by Australian aged care providers, every dollar counts.

Mirus Australia’s data-driven insights and solutions make a compelling case for addressing revenue leakage head-on, allowing providers to turn these financial gaps into opportunities for reinvestment and growth. Taking steps toward comprehensive billing, data management, and revenue cycle improvements can help make revenue leakage a thing of the past, enabling providers to focus on their ultimate mission: delivering quality care to Australia’s aged care residents.

Request a revenue leakage analysis for your facilities today.