Financial sustainability in Aged Care: Insights from industry data

July 4, 2024 | AN-ACC

By Tyler Fisher, Data Scientist

In this blog, we delve into the insights gained from the Quarterly Financial Report (QFR) data to understand the operational hurdles and potential strategies for achieving surplus.

Financial performance across the sector

On average, the industry operates at a deficit of approximately $11 per resident per day. When this figure is annualised across 190,000 residents, it translates to a staggering loss exceeding $700 million. However, the actual reported deficit across all facilities is closer to $140 million, indicating variability in financial health across different services.

Compliance and staffing challenges

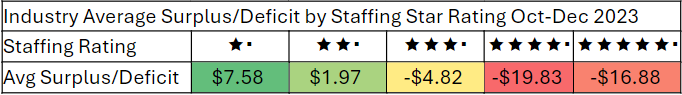

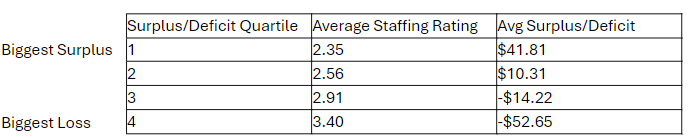

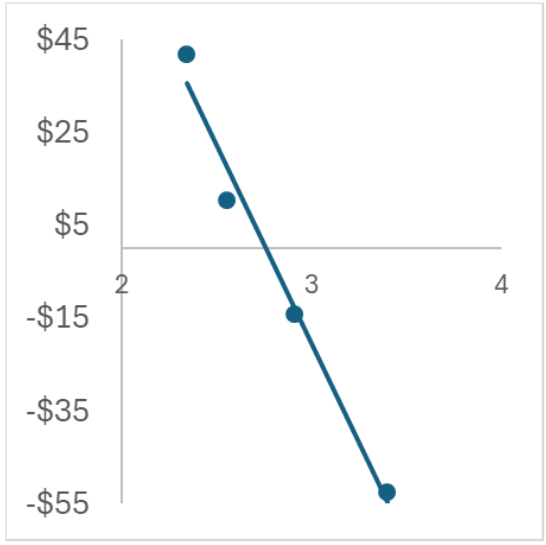

Our data also highlights the intricate balance between financial performance and compliance with staffing requirements. Services with higher staff ratios, which are essential for compliance, often see a worsening financial deficit. For instance, minimally compliant services with a three-star rating face an average deficit of almost $5 per resident per day, and this deficit increases for services with four and five-star ratings.

Interestingly, a strong inverse correlation exists between staffing ratios and financial surplus. The correlation coefficient for this data is a striking -0.9897, indicating that as staffing levels rise to meet compliance, financial deficits grow proportionally.

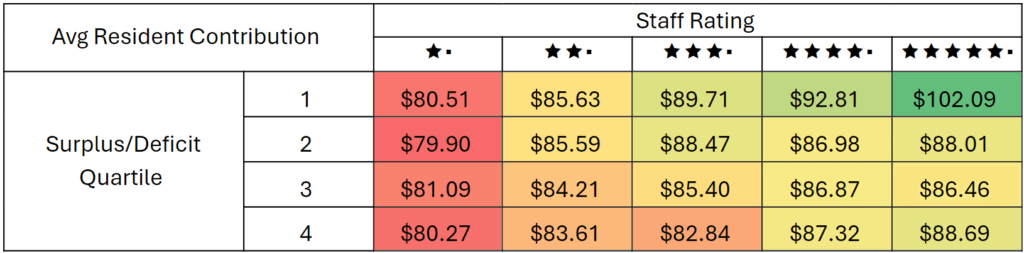

The role of Resident Contributions

Financial performance and compliance are strongly linked to resident contributions. Healthy financial outcomes within compliance constraints are largely driven by these contributions. This emphasizes the need for aged care providers to manage resident contributions effectively to maintain financial stability.

Government pricing adjustments

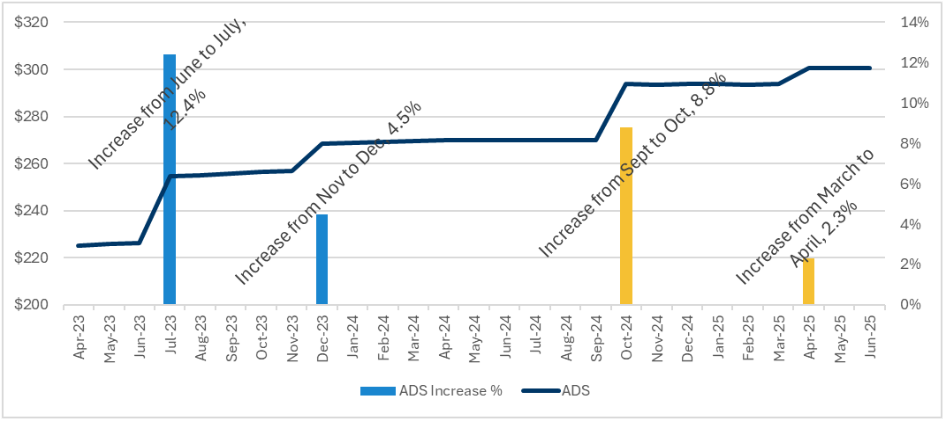

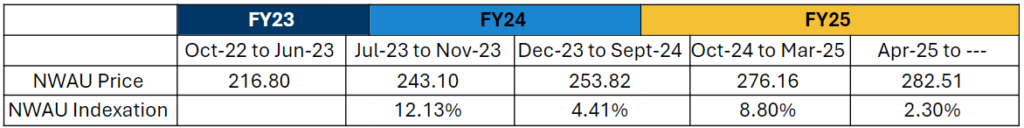

The sector’s financial landscape is also influenced by government policies and pricing adjustments. Last year’s interim 15% wage increase for direct care workers, promised and funded by the Commonwealth, was a significant factor. However, many workers were already earning above the minimum wage, resulting in an effective wage expense increase of just over 12%, bringing the National Weighted Average Unit (NWAU) to $243.10. An additional increase in December further adjusted this figure.

Looking ahead, the government appears to be adopting an incremental approach to pricing. We anticipate that the new financial year will bring a price adjustment reflecting inflation and the Fair Work Commission’s decisions. This could mean an initial indexation of 8 to 12% in October, with the possibility of a secondary adjustment in April.

Strategic considerations for Providers

Here are some of our recommendations for taking a leading approach to creating surplus revenue:

- Optimise staffing: Achieve the necessary care minute requirements while minimising financial deficits.

- Manage resident contributions: Ensure contributions are aligned with the costs of providing high-quality care.

- Anticipate Government adjustments: Stay informed about upcoming pricing changes and plan accordingly.

Achieving a balance between compliance, staffing, and financial performance is more crucial than ever. By leveraging data insights and adopting strategic approaches, providers can navigate these challenges and move towards sustainable profitability.

If you’d like support with your strategy for profitability, please get in touch.